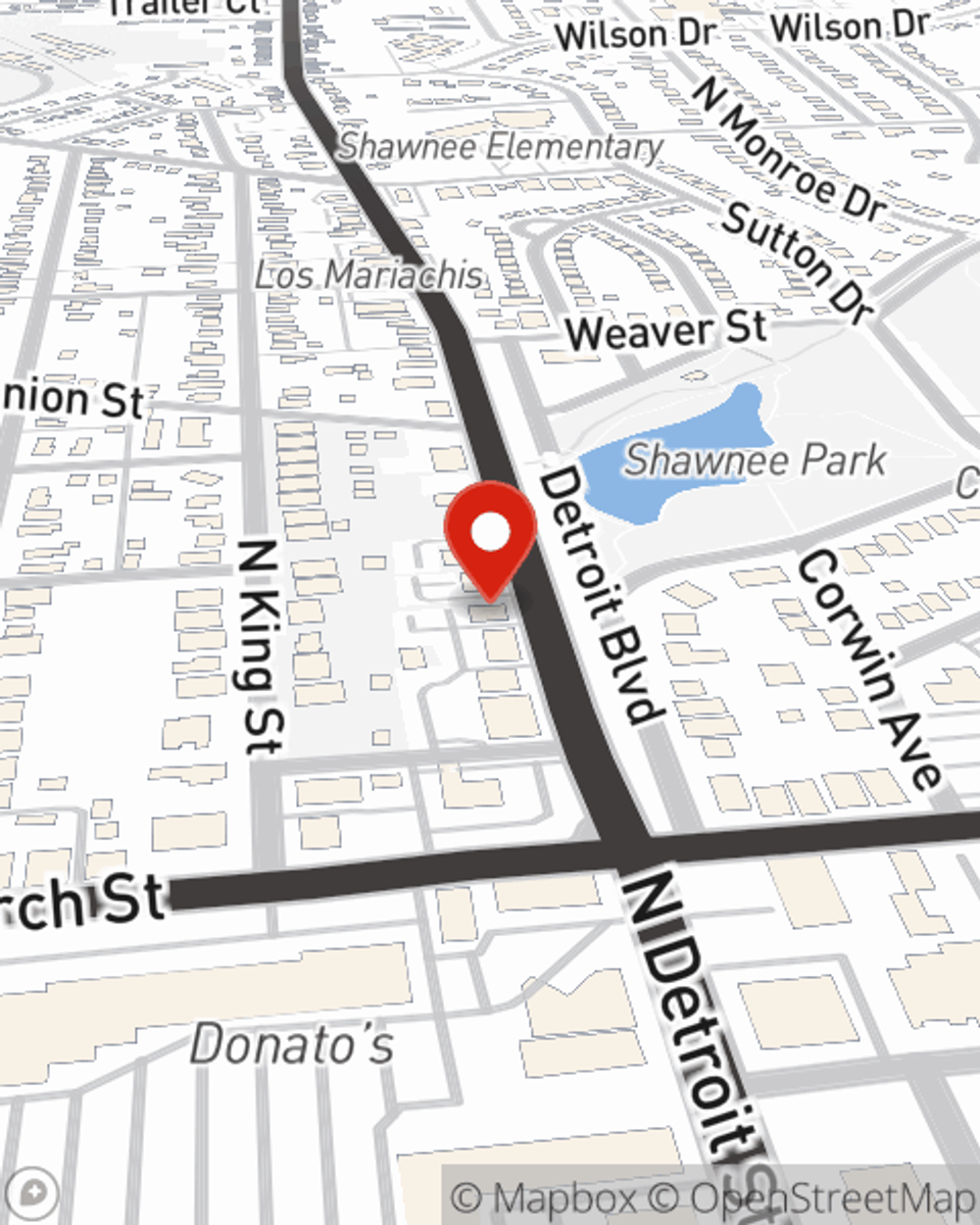

Life Insurance in and around Xenia

Get insured for what matters to you

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

People obtain life insurance for individual reasons, but the ultimate goal is almost always the same: to ensure a certain financial future for the people you're closest to after you're gone.

Get insured for what matters to you

Life won't wait. Neither should you.

Why Xenia Chooses State Farm

When it comes to picking how much coverage you need, State Farm can help. Agent Rick Kolmin can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your current age, how healthy you are, and sometimes even lifestyle. By being aware of these elements, your agent can help make sure that you get a suitable policy for you and your loved ones based on your individual situation and needs.

Reach out to State Farm Agent Rick Kolmin today to learn more about how the trusted name for life insurance can help you rest easy here in Xenia, OH.

Have More Questions About Life Insurance?

Call Rick at (937) 372-3700 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Rick Kolmin

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.